The process of breaking these payments up into smaller transactions to avoid detection is known as “structuring.” In some cases, it could lead to criminal charges. In many cases, a SAR will be filed despite these efforts. Others will break the transaction up into multiple smaller withdrawals or deposits. Some customers that learn about the $10,000 reporting requirement will opt to lower the amount of their transaction. In many cases, the targets of a SAR investigation will never learn it occurred. The investigation will go on without any notice being provided to the customer. This report must be filed within 30 days of the suspicious transaction in most cases. The Financial Crimes Enforcement Network – a division of the United States Treasury – is charged with investigating these transactions. The SAR must be filed by the bank with the Financial Crimes Enforcement Network. If a bank customer refuses the transaction or modifies it to fall below the threshold, the bank employee is required to file a suspicious activity report.Ī suspicious activity report, or SAR, is the standard form used by banks to report suspected criminal activity during bank transactions.

The reporting requirement for a CTR is triggered when a bank customer initiates a transaction of more than $10,000, not when they complete it. While the customer has the right to cancel the transaction upon learning of the CTR requirement, it is likely too late to stop the bank reporting the situation. However, the bank officer must inform the customer truthfully if they inquire about the CTR requirement. This would trigger a further investigation into the possibility of money laundering.Ī bank or other financial institution is under no obligation to inform a customer when their transaction triggers a CTR. Given that these forms are drafted by the banks themselves, they include a checkbox that gives employees an opportunity to flag it as suspicious.

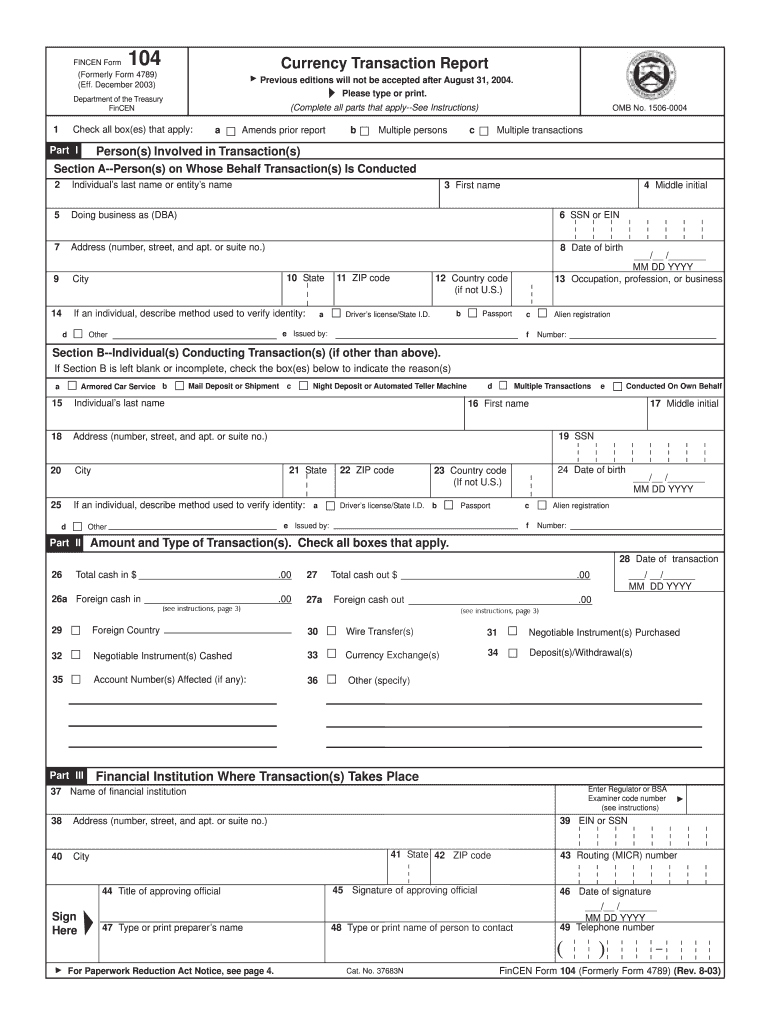

CURRENCY TRANSACTION REPORT SOFTWARE

This software typically fills in the relevant tax data and customer information required on the form. Each time a bank or other financial institution is presented with a transaction of over $10,000, typical banking software will generate a CTR automatically. The process for generating a CTR during a large transaction is largely automatic.

CURRENCY TRANSACTION REPORT FREE

To learn more, schedule a free consultation as soon as possible. Attorney Doug Murphy is experienced in defending those accused of federal white-collar crimes. If you are facing federal charges related to the failure to file a CTR, you should consult legal counsel right away. Any white-collar crime involving bank transactions or large transfers of money could be prosecuted using CTRs as evidence.Ĭompliance with these federal laws is important, but mistakes can happen. These reports can play an important role in any number of federal prosecutions. The forms required to track these large transactions are known as Currency Transaction Reports (CTR). While it is impossible for the IRS to track every bank transaction, they have enacted special reporting requirements for larger transactions in an effort to combat fraud and money laundering. The Internal Revenue Service takes a particular interest in large currency transactions.

0 kommentar(er)

0 kommentar(er)